Since opening in 2007, Devens Recycling, Devens, Massachusetts, has become an acquisition target for construction and demolition (C&D) waste processors looking to expand into the New England market.

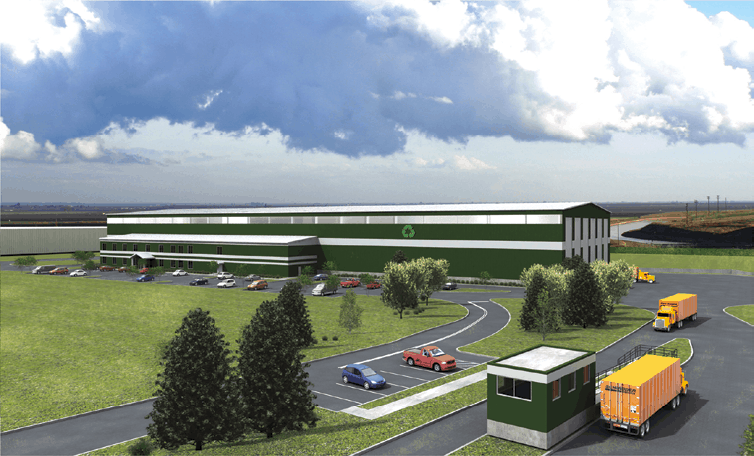

Operating on 11 acres on the site of the former Fort Devens military base, the over 100,000-square-foot C&D recycling and waste transfer facility was once described as “the largest fully enclosed state-of-the-art construction and demolition transfer station” in the U.S. by the MetroWest Daily News in 2009.

After building its footprint organically in the Massachusetts market, Devens’ co-owner Kurt Macnamara sought to test the interest in merger and acquisition (M&A) activity with possible interested parties.

“We could only take it so far without either acquiring some smaller assets, or having to be acquired by someone else,” Macnamara says. “I really wanted [to sell Devens to] a company that was 100 percent committed to C&D recycling.”

Although the facility attracted multiple interested parties, Macnamara decided to partner with Phoenix-based Republic Services in an acquisition that was finalized in February.

_fmt.png)

MAKING A DEAL

“We [already] had a relationship with [Republic] because they were one of our customers, and then it just kept growing,” Macnamara says. “I started talking to Nick [Stefkovich, Republic’s market vice president for operations in New England and upstate New York,] a couple years ago and he coached me on getting [the company] to a certain point where they might consider acquiring it.”

According to Stefkovich, Devens was a good acquisition target for two reasons: it had the ability to transfer material to distant locations via its rail access thanks to its status as the largest operational rail transfer facility in Massachusetts, and it had the ability be a prolific processor in the Massachusetts construction debris market.

“We needed the ability to move material, but it’s not uncommon for alternative disposal capacity in states [to] be unavailable. As a collector, and with many C&D facilities in the market already full, it was better to be an owner and operator than a customer. [With Devens], we know that we now can support our collection operations,” he says.

Space for waste disposal is currently a growing concern in Massachusetts, with the state’s projected disposal capacity expected to shrink from 5.2 million tons in 2017 to 4.6 million tons this year, as reported by the Telegram & Gazette.

In addition to the state’s strained disposal capacity, Stefkovich says Massachusetts’ strict regulatory framework for C&D processing was also a primary driver in Republic’s acquisition.

“[The state] requires all of the material that comes from construction sites to go through a processing system and certain materials are required to be extracted,” he says.

The Massachusetts Department of Environmental Protection (MassDEP) introduced its first waste bans on landfilling and combustion of easy-to-recycle and toxic materials in 1990. In 2006, MassDEP added multiple C&D categories to the list, including asphalt pavement, ferrous and nonferrous metal, treated and untreated wood, clean gypsum wallboard, and more.

Most recently, the state established a 15 percent process separation rate requirement for C&D facilities this year, prompting a possible increase in demand for C&D recycling.

“[The regulations] give us—the processor—some certainty around volumes. We’re able to build some confidence that we’re going to have the volumes we need to run the facility. I would think the regulatory framework really helps support the New England market,” Stefkovich says.

THE FACILITY

Devens, which is currently permitted to accept up to 1,000 tons of C&D and 500 tons of MSW via truck and rail, has already met the 15 percent threshold per the state’s latest data. But, depending on how Republic chooses to utilize the site, it’s possible the company could pursue a higher overall capacity cap.

According to a 2019 study conducted by the Orlando, Florida-based MSW Consultants for MassDEP, C&D makes up a notable portion of out-of-state waste shipments. This is especially notable for Republic, as the Devens facility has direct rail access.

With Devens located in close proximity to a Pan Am Class 2 railway, Republic will now be able to shift material from its local collection and transfer operations to many of its company-owned landfills in other states, as well as to outbound customers.

“I think it’s an asset because if we need rail service, they’re a stone throw away. It’s not a big production to get a switch,” says Stefkovich.

As reported by the MetroWest Daily News, Devens’ clientele includes major universities and developers in Massachusetts, as well as companies like Kennedy Concrete, Vineland, New Jersey, and Excel Recycling LLC, Freetown, Massachusetts, whom receive the facility’s metal and concrete.

To process material at a rate of 35 tons per hour, Devens currently utilizes an OEM Sherbrooke C&D processing system, a General Kinematics destoner, a Peterson grinder and a Terex wheel loader, among other specialty equipment.

“The financial commitment to recycling construction and demolition materials is huge. There are tens of millions of dollars of equipment in there to support that process,” says Macnamara.

MOVING FORWARD

Of Devens 30 employees, all have remained at the company following the acquisition.

“[Republic] has been a great partner,” says Macnamara. “I’m still working there and [am] still very much involved, and Nick has been a great guy to work with—the whole company has.”

Stefkovich adds, “Obviously, there’s a period of time where people adjust to a new company and a new culture. But I’ve been with [Republic] for 22 years and we treat people well and support them. If you approach management of people from a place of respect, you can build good rapport and get things done.”

Since beginning operations on Feb. 1, Stefkovich says Republic has been taking a step-by-step approach to managing the facility. With no immediate equipment changes in the queue, Republic plans to operate and run the system for a period to better understand it before deciding on any changes.

“The whole idea behind [Devens made it] one of the first of its kind in Massachusetts,” says Macnamara. “It was basically large enough so it was like an indoor landfill. This facility fills such a need with the lack of space now at these landfills, and we have the technology to recycle this incoming stuff and make something out of it.”

He adds, “And that’s Republic’s mission—they are 100 percent committed to recycling and improving the quality of their recycled materials. I’d like to think Devens really was a piece that they could plug into their system and make the company thrive.”

Given the company’s work building Devens into one of the largest operators in the region, Macnamara says he is excited it is in good hands.

“[Republic] is definitely committed to the mission of recycling more and more construction and demolition material. So, I’m pretty excited that I was able to get them interested in acquiring Devens. It’s not every day you get a Fortune 500 company interested in your business,” he says.

This article originally appeared in the July/August issue of Construction & Demolition Recycling magazine. The author is the assistant editor of Construction & Demolition Recycling and can be reached at hrischar@gie.net.

Latest from Construction & Demolition Recycling

- EPA announces $3B to replace lead service lines

- NWRA honors award recipients during annual breakfast at WasteExpo

- Safe Fleet, ITA Dynamics unveil integrated financial, route management system

- Bateman unveils 210 series orange peel grapple

- Republic reports first quarter growth

- Meridian Waste completes second acquisition of 2024

- NEPA revisions could delay critical infrastructure, ABC says

- Liebherr USA announces new divisional director