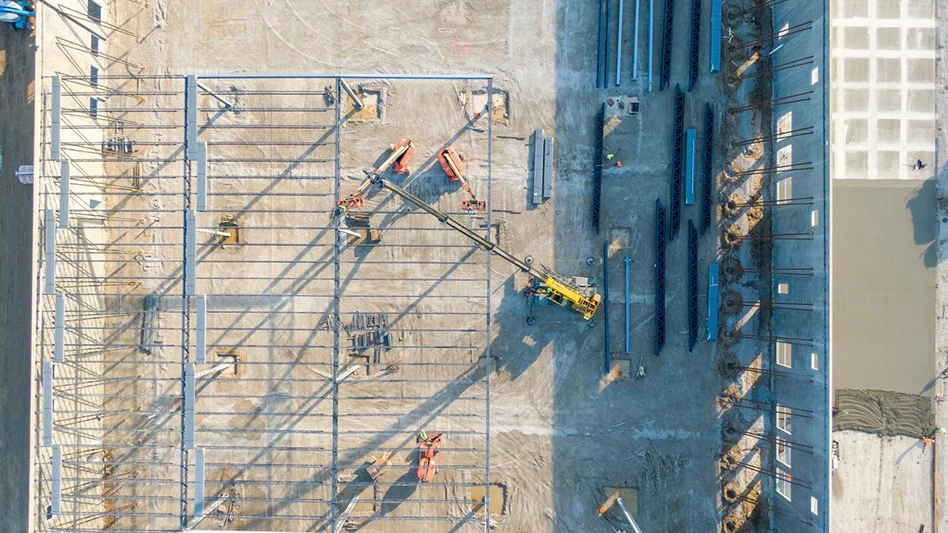

Photo courtesy of Nucor Corp.

Nucor Corp. has announced fourth quarter 2025 earnings that are nearly 32 percent higher compared with a year earlier, though for the full year of 2025, the Charlotte, North Carolina-based steelmaker garnered net earnings below the level it reached in 2024.

Nucor, which operates recycled-content electric arc furnace (EAF) steel mills and the David J. Joseph (DJJ) network of metal recycling facilities, has reported net earnings attributable to shareholders of $378 million for last year’s fourth quarter, a 31.7 percent increase from $287 million in late 2024.

The company, which also makes numerous downstream steel-containing building products, earned more than $1.74 billion in 2025, a 14 percent decline from the more than $2 billion it cleared in 2024.

“I want to thank our teammates for their tremendous work throughout 2025—delivering for our customers, advancing key growth projects and making this Nucor's safest year,” CEO Leon Topalian says.

“During the year, we brought several major projects online, including our new rebar micromill in Lexington, North Carolina; the Kingman, Arizona, melt shop; our Alabama Towers and Structures facility; and our coating complex in Crawfordsville, Indiana. As these and other recently completed projects ramp up, they are beginning to deliver meaningful earnings contributions and we believe they will play an important role in strengthening our earnings power over time.

“Looking ahead to 2026, we are encouraged by robust demand in several key end markets, historically strong backlogs and federal policies that support a vibrant domestic steel industry. Our focus remains on execution and generating strong, through‑cycle returns for our shareholders.”

Nucor's earnings in its EAF steel mills segment decreased in the fourth quarter of 2025 because of lower volumes and margin compression, primarily at sheet steel mills.

The firm says earnings in its raw materials segment, which includes the DJJ recycling operations, decreased in the final quarter of 2025 mainly as a result of two scheduled outages at its direct reduced iron (DRI) facilities that were partially offset by insurance recoveries.

Regarding the quarter now underway, Nucor predicts its raw materials segment will enjoy increased earnings compared with the quarter just completed and also expects earnings to increase, with the largest increase in the steel mills segment.

Nucor says it anticipates higher volumes and higher realized prices across all major product categories in its steel mill sector in early 2026.

Latest from Construction & Demolition Recycling

- G2 Consulting Group acquires Construction Testing Services

- CBI to showcase 5900T horizontal grinder at ConExpo 2026

- Steel Dynamics reports 2025 financial results

- Global steel output continues slide in December 2025

- Smart equipment maintenance: How geofencing drives productivity

- Demo Leaders launches zero-waste program

- BrightRidge to demolish 2 buildings in Tennessee

- Amrize to acquire PB Materials