Amsterdam-based GRESB, Global ESG (environmental, social and governance) Benchmark for real assets, has released the results of its annual 2017 GRESB Real Estate Assessment for the North American real estate sector.

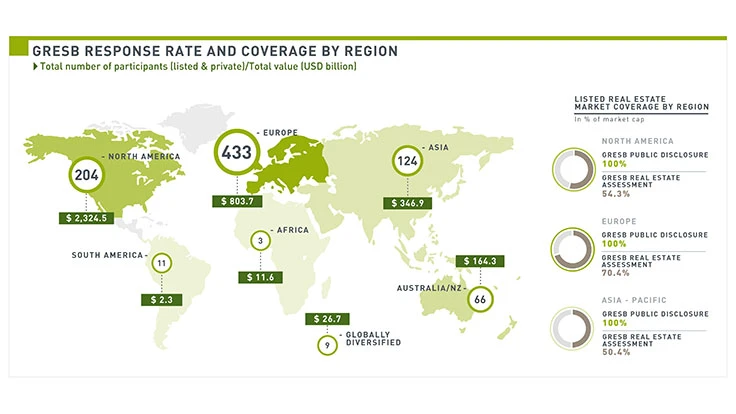

Globally, a record 850 property companies and real estate funds completed the Assessment, representing 77,000 assets and over $3.7 trillion in value. The average GRESB score increased to 63 points, up three from 2016. Listed property companies continue to outperform private entities, and entities focused on offices outperform other property types.

The new GRESB data shows tangible improvements in ESG performance. Globally in 2017 the sector:

diverted 52.9 percent of landfill waste - equivalent to 399,008 truck loads;

reduced like-for-like energy consumption by 1.1 percent - equivalent to 79,827 U.S. homes;

reduced like-for-like carbon emissions by 2.2 percent - equivalent to 113,000 passenger cars; and

reduced like-for-like water consumption by 0.5 percent - equivalent to 999 Olympic swimming pools.

The results show that the energy improvements made in recent years by the global real estate sector are in line with the energy reductions targets as set out in the United Nations-supported Sustainable Development Goals.

“We are delighted to see an increase in the number of participants and assets across all regions for eight consecutive years. It’s encouraging that, once again, GRESB participants were able to lower energy, water and carbon emissions. We hope that the commitment and meaningful actions taken by the 850 GRESB participants serve as an example to others and help to drive improved sustainability performance more broadly across the market.” says Sander Paul van Tongeren, co-founder and managing director at GRESB

“GRESB is the only industry-driven organization committed to assessing the ESG performance of real asset portfolios globally – with sustainable real assets as the end goal," says Mahesh Ramanujam, president and CEO of Green Business Certification Inc. (GBCI) and GRESB Board member. “Now in its eighth year, GRESB Real Estate Assessment participants are showing their commitment to providing quality data and making a big impact on performance. This year saw a record number of GRESB assessment participants and GBCI will continue to invest in GRESB to deliver the immense market transformation potential.”

North American Real Estate Sector Highlights:

204 companies and funds in North America representing $2.3 trillion in assets under management reported on their ESG performance in 2017. This represents a 15 percent increase in participants from 2016. The average GRESB Score for the region increased to 64 from 59. This not only represents a higher rate of increase than other regions, but also places the North American sector ahead of the global average.

North American property companies and funds achieved a 2.5 percent reduction in energy consumption, a 2.9 percent reduction in carbon emissions and a 1.3 percent reduction in water consumption.

Over 59 companies and funds in North America completed the voluntary Health & Well-being Module, a sign that the region is embracing this important industry theme, says GRESB. “We are proud to announce that Center for Active Design is our newest Global Partner. Both the Centre for Active Design and Delos have been instrumental in elevating this topic in the real estate sector and we are excited that we are now partners with the two leading initiatives on health and well-being,” GRESB says in a press release.

For more information on the 2017 GRESB data and Regional Sector Leaders, visit the GRESB real estate results page.

Latest from Construction & Demolition Recycling

- Vecoplan to present modular solutions at IFAT 2026

- Terex Ecotec appoints Bradley Equipment as Texas distributor

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest

- Triumvirate Environmental acquires Environmental Waste Minimization

- Coastal Waste & Recycling expands recycling operations with Machinex

- Reconomy acquires German-based GfAW