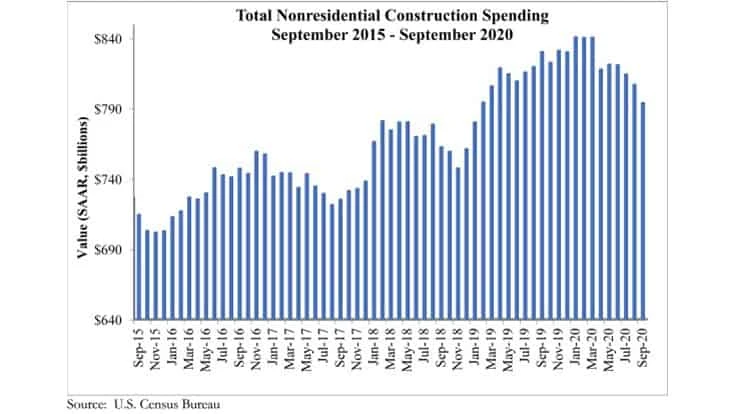

National nonresidential construction spending fell 1.6 percent in September, according to an Associated Builders and Contractors (ABC) analysis of data published Nov. 2 by the U.S. Census Bureau. On a seasonally adjusted annualized basis, monthly spending totaled $794.3 billion.

Among the 16 nonresidential subcategories, 13 were down on a monthly basis. Private nonresidential spending declined 1.5 percent in September, while public nonresidential construction spending was down 1.7 percent.

“The pace… of decline in nonresidential construction spending is accelerating,” says ABC Chief Economist Anirban Basu. “This is precisely what had been predicted. Coming into the crisis, the economy was rolling, helping to lift construction backlog amid elevated developer confidence, according to ABC’s Construction Backlog Indicator and Construction Confidence Index. The crisis shattered that equilibrium, producing distressed commercial real estate fundamentals, diminished confidence, postponed and cancelled projects, the embrace of remote work, tighter credit conditions and damaged state and local government finances.”

Though the initial phase of economic recovery has been brisk, Basu says economic outcomes are likely to deteriorate markedly during the months ahead absent further stimulus.

“That would further delay nonresidential construction’s eventual recovery. Nonresidential construction spending is down 4.4 percent from the same time last year, with lodging-related spending down more than 15 percent and office-related spending down nearly 7 percent. These are among the segments hardest hit by social distancing directives, and another round of shutdowns would further exacerbate declines in these and other segments,” Basu says.

He adds, “The hope is that policymakers in Washington, D.C., will soon see fit to deliver on a long-awaited infrastructure financing and spending program. Not only would that accelerate the broader economy’s economic recovery, a well-executed infrastructure package would make American workers more productive, unleash new private development opportunities and allow America to better compete in the global marketplace. The longer America has to wait for such a package, however, the more vulnerable its citizens will be to further economic dislocations.”

Latest from Construction & Demolition Recycling

- Vecoplan to present modular solutions at IFAT 2026

- Terex Ecotec appoints Bradley Equipment as Texas distributor

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest

- Triumvirate Environmental acquires Environmental Waste Minimization

- Coastal Waste & Recycling expands recycling operations with Machinex

- Reconomy acquires German-based GfAW