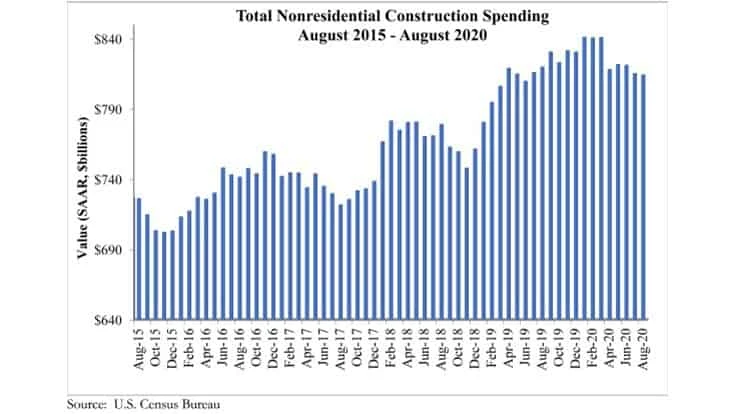

National nonresidential construction spending fell 0.1 percent in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $814.3 billion for the month.

Of the 16 nonresidential subcategories, nine were down on a monthly basis. Private nonresidential spending decreased 0.3 percent from July, while public nonresidential construction spending was up 0.2 percent. Nonresidential construction spending is down 0.7 percent compared to August 2019.

“While overall construction spending rose significantly in August, much of that was attributed to surging single-family housing starts,” says ABC Chief Economist Anirban Basu. “The picture is very different in a number of nonresidential construction categories, especially in segments that have been disproportionately impacted by the pandemic, such as lodging and office, which are down 12.1 percent and nearly 9 percent year over year, respectively.

According to Basu, the good news is that nonresidential construction spending momentum remains apparent in a number of public segments. On a monthly basis, construction spending was up in the water supply, highway/street and educational categories. Spending in the public safety segment is up nearly 40 percent compared to the same time last year.

“Absent an infrastructure-oriented stimulus package, the likely trajectory of nonresidential construction spending does not appear especially bright,” says Basu. “Commercial real estate fundamentals are poor, with elevated vacancy rates and tighter lending conditions, rendering it probable that private nonresidential construction spending will continue to dip. State and local finances have been pummeled by the pandemic, resulting in less support for the next generation of public projects. Many contractors report declining backlog, according to ABC’s Construction Backlog Indicator, and fewer opportunities to bid on new projects. With winter coming and infection rates poised to rise, the quarters to come are shaping up to be challenging ones.”

Latest from Construction & Demolition Recycling

- Waste Pro files brief supporting pause of FMCSA CDL eligibility rule

- Des Moines project utilizes recycled wind turbine blades

- Vecoplan to present modular solutions at IFAT 2026

- Terex Ecotec appoints Bradley Equipment as Texas distributor

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest

- Triumvirate Environmental acquires Environmental Waste Minimization