Recycling Today archives

The price of copper on the London Metal Exchange (LME) and the United States-based Comex exchange experienced brief spikes above $6.50 per pound this week before quickly surrendering much of that newly gained value.

During Thursday, Jan. 29, trading, the price of copper on the LME moved up to more than $14,500 per metric ton ($6.62 per pound) before just as quickly heading back down to around $13,400 per metric ton ($6.08) later in the same day.

Copper at either price is at the upper end of trading for the red metal. “These volatile moves come on the back of robust gains in the final quarter of 2025, where LME three-month copper posted a 21 percent jump, its best quarterly performance since the second quarter of 2020,” writes Natalie Scott-Gray, a London-based metals demand analyst with StoneX.

While Scott-Gray says tariffs joined traditional supply and demand dynamics in determining the value of copper in 2025, she adds, “However, as we’ve entered 2026, the sheer pace of gains has removed copper price action away from these traditional price drivers. Indeed, given the speed at which fundamentals can change (months-to-quarters), these price moves cannot be justified by them. Therefore, it is evident that the role of speculators is behind this.”

On Friday, Jan. 30, Bloomberg reported that the LME had delayed the opening of trading that morning, citing “technical issues” later described in media reports as a power outage.

The Hong Kong-based AAStocks.com website reports having seen an LME notice to brokers indicating the technical issues were “under investigation,” and that the LME's electronic trading platform had been suspended.

Traders may have wondered whether the pricing volatility had provoked a response from the exchange in a situation that may have brought back memories of the 2022 price volatility in its nickel contract.

While Scott-Gray of StoneX points to the role of speculation, she adds that market fundamentals can play a role in how bankers and fund managers take positions in the copper market.

“Taking a deeper dive into LME commitment of trader reports, which are designed to ‘reflect the nature of the predominant business activity that LME members and their clients are involved in using,’ the most recent rise in copper prices isn’t purely driven by speculative appetites; in fact the speculative market appears to have moved into profit-taking mode,” she writes in her Jan. 29 analysis.

Adds Scott-Gray, “Instead, it is commercial undertaking positions that are increasing their long exposure to copper, a bullish signal to the market, suggestive (we believe in this case) that producers, consumers and merchants of copper are hedging to lock in prices before potential further price spikes.”

In addition to tariffs, the (currently falling) value of the U.S. dollar is another factor in copper pricing, says the analyst.

“We expect movements in the U.S. dollar will remain a key price driver, offsetting concerns from underlying global fundamentals such as demand,” writes Scott-Gray. “In turn, we expect copper to trade in a new higher normal range over this period, posting bouts of volatility within the forward curve.”

Latest from Construction & Demolition Recycling

- Volvo CE reports sales decrease in 2025

- Nasco-Op declares dividend

- CDRA Conference & Tradeshow 2026: CDRA honors annual award recipients

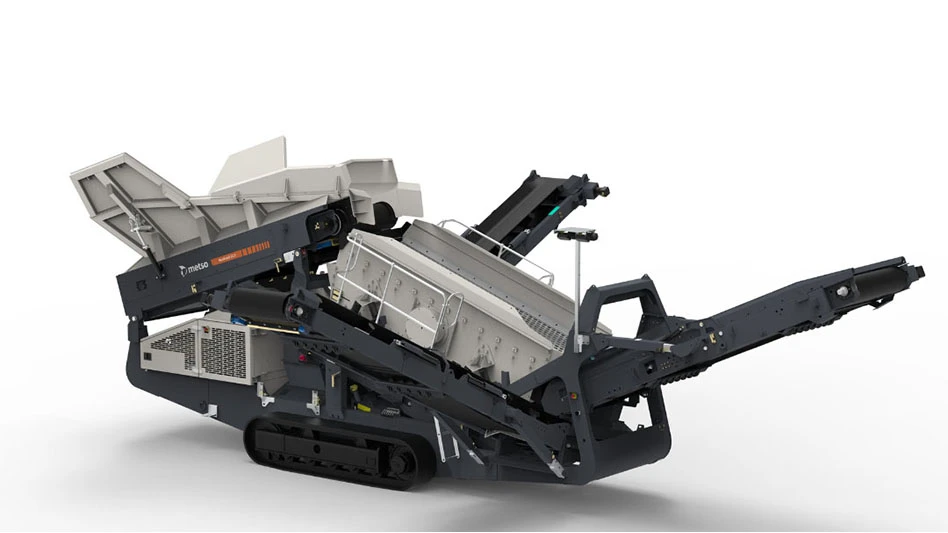

- Cedarapids to spotlight impact crusher at ConExpo

- Vecoplan appoints CFO

- CDRA Conference & Tradeshow 2026: Creating a market for gypsum recycling

- John Deere announces plans to open 2 new U.S. facilities

- Company incorporates safety, cost of ownership considerations in demo equipment offerings