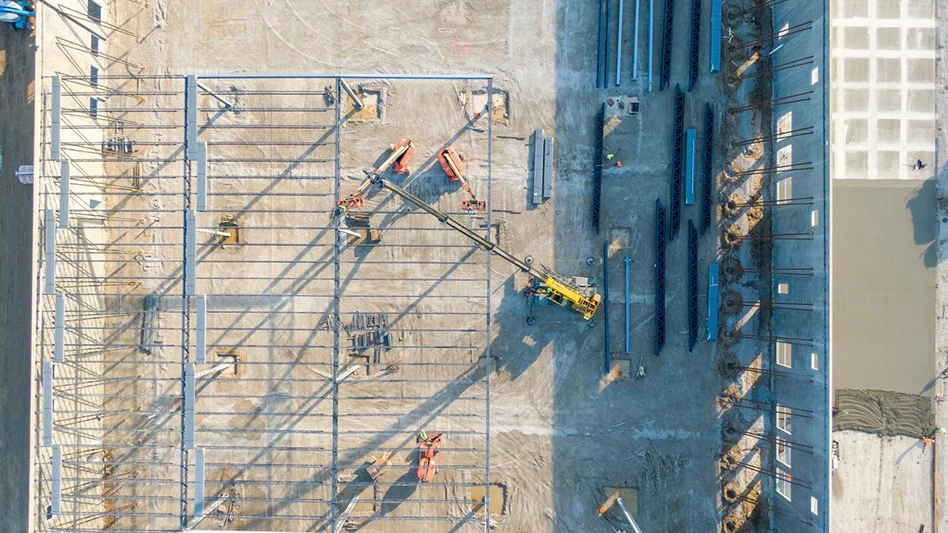

Tund | stock.adobe.com

A survey of its members taken by the Arlington, Virginia-based the Associated General Contractors of America (AGC), along with federal government statistics, portray a construction sector confronting higher costs for materials such as metal and lumber that may be contributing to slower hiring practices in numerous states.

AGC says federal government producer price index (PPI) information shows prices for materials and services used in nonresidential construction rose 0.2 percent in August and have risen 2.5 percent since August 2024, “driven by extreme increases in steel and aluminum prices.”

The association notes a survey it conducted with the Florida-based the National Center for Construction Education and Research (NCCER) NCCER recently released found rising costs were one of the key reasons for delayed, canceled, or scaled-back projects.

August PPI figures show the price index for aluminum mill shapes jumped 5.5 percent last month and 22.8 percent from August 2024. The index for steel mill products rose 1.5 percent in August and have risen by 13.1 percent in a 12-month span while the index for lumber and plywood increased 0.5 percent for the month and 4.8 percent year-on-year.

AGC says tariffs on steel and aluminum were raised to 50 percent on June 4 while 50 percent tariff on copper products and components took effect on August 1. In addition, broad tariffs covering most imports from nearly all major suppliers of construction materials were activated in early August, making additional cost increases likely in the months ahead, predicts the association.

“The huge increases in steel and aluminum tariffs appears to have enabled domestic producers to push up their selling prices,” says Ken Simonson, the association’s chief economist.

He says the AGC-NCCER survey found that 43 percent of contractors reported at least one project in the past six months had been canceled, postponed or scaled back because of higher costs. “These price increases are prompting some owners to rethink planned construction projects,” says Simonson.

AGC says it is urging the administration of Donald J. Trump to resolve outstanding disputes with China, Canada, Mexico and several other trading partners to allow for lower tariff rates and provide greater certainty on materials prices.

“There is a limit to how many price increases the market can absorb before owners put projects on hold,” said Jeffrey D. Shoaf, the CEO of AGC. “The more the administration does to resolve trade disputes, provide more certainty and lower punitive tariff levels, the more demand for construction should rebound.”

Federal government hiring statistics for this August show construction employment increased in 28 states and the District of Columbia this August compared with a year earlier, while only 19 states added construction jobs between this July and this August.

“Most firms are struggling to find enough workers to hire amid persistent labor shortages,” says Simonson. “These labor shortages are the number one cause for delayed construction projects, according to our recent survey.”

Among states that added construction jobs are Texas, Ohio and Virginia while those losing overall construction sector jobs include California, Nevada, Louisiana and New Jersey.

“The lack of qualified workers is making it harder for the economy to expand,” says Shoaf.

Latest from Construction & Demolition Recycling

- Nucor finishes 2025 with 14 percent earnings decline

- G2 Consulting Group acquires Construction Testing Services

- CBI to showcase 5900T horizontal grinder at ConExpo 2026

- Steel Dynamics reports 2025 financial results

- Global steel output continues slide in December 2025

- Smart equipment maintenance: How geofencing drives productivity

- Demo Leaders launches zero-waste program

- BrightRidge to demolish 2 buildings in Tennessee