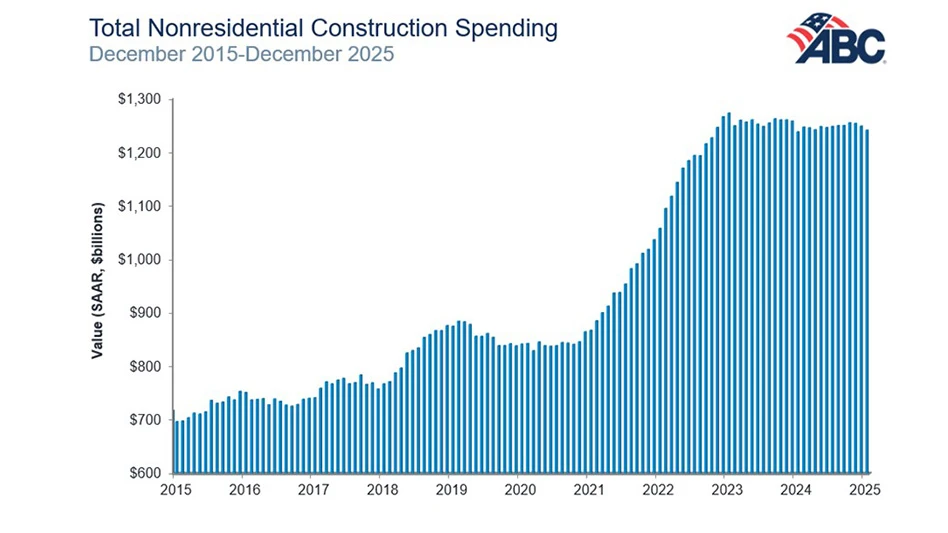

Construction spending is at record levels for the second straight month in March and is up 4.9 percent for the first three months of year compared to the same period in 2016, despite dipping slightly compared to February, according to an analysis by the Associated General Contractors of America (AGC) in Arlington, Virginia. Association officials said many firms are eager to see details of the president’s pending infrastructure plan.

“Construction spending totals during the past two months are at the highest levels we have ever seen,” says Stephen E. Sandherr, the association's CEO. “If the winter weather hadn’t been so mild in much of the country, we would have seen less growth in February and a higher rate of growth in March, but overall demand remains quite robust.”

Construction spending in March totaled $1.218 trillion at a seasonally adjusted annual rate, essentially unchanged from the month before, Sandherr says. He added that the year-to-date increase of 4.9 percent for January through March 2017, compared with the same months of 2016, shows demand for construction continues to experience growth.

The construction official noted that private nonresidential spending declined by 1.3 percent for the month and is up 6.4 percent year-to-date. The largest private nonresidential segment in March was power construction, including oil and gas pipelines, which fell by 0.6 percent for the month but is up 8.2 percent year-to-date. The next-largest segment, manufacturing, expanded by 0.5 percent for the month but is down 9.8 percent year-to-date. Commercial construction, including retail, warehouse and farm, dropped by 3.2 percent in March but climbed 12.7 percent year-to-date. Private office construction decreased by 2.6 percent for the month but grew by 17.7 percent year-to-date.

Private residential construction spending edged up by 1.2 percent between February and March 2017, and was up 7.5 percent year-to-date. Spending on multifamily residential construction increased by 2.0 percent for the month and is up 7.4 percent year-to-date, while single-family spending inched up 0.3 percent from February to March and is up 4.7 percent year-to-date.

Public construction spending declined 0.9 percent from a month before and is now down by 6.5 percent for the first three months of 2017. The biggest public segment—highway and street construction—increased by 0.5 percent for the month but is down 2.4 percent year-to-date. The other major public category—educational construction—fell by 2.0 percent in March and by 2.6 percent for the combined January to March period.

Association officials say that the decline in public construction spending highlights the need for new infrastructure proposals. They add that many firms are eager for the administration to release details about the new plan, and significant new investments in infrastructure will help boost overall economic activity and support greater demand for construction services.

“If Washington officials can find a way to enact significant new infrastructure funding, we are likely to see even higher record levels of construction spending for the foreseeable future,” says Sandherr.

“Construction spending totals during the past two months are at the highest levels we have ever seen,” says Stephen E. Sandherr, the association's CEO. “If the winter weather hadn’t been so mild in much of the country, we would have seen less growth in February and a higher rate of growth in March, but overall demand remains quite robust.”

Construction spending in March totaled $1.218 trillion at a seasonally adjusted annual rate, essentially unchanged from the month before, Sandherr says. He added that the year-to-date increase of 4.9 percent for January through March 2017, compared with the same months of 2016, shows demand for construction continues to experience growth.

The construction official noted that private nonresidential spending declined by 1.3 percent for the month and is up 6.4 percent year-to-date. The largest private nonresidential segment in March was power construction, including oil and gas pipelines, which fell by 0.6 percent for the month but is up 8.2 percent year-to-date. The next-largest segment, manufacturing, expanded by 0.5 percent for the month but is down 9.8 percent year-to-date. Commercial construction, including retail, warehouse and farm, dropped by 3.2 percent in March but climbed 12.7 percent year-to-date. Private office construction decreased by 2.6 percent for the month but grew by 17.7 percent year-to-date.

Private residential construction spending edged up by 1.2 percent between February and March 2017, and was up 7.5 percent year-to-date. Spending on multifamily residential construction increased by 2.0 percent for the month and is up 7.4 percent year-to-date, while single-family spending inched up 0.3 percent from February to March and is up 4.7 percent year-to-date.

Public construction spending declined 0.9 percent from a month before and is now down by 6.5 percent for the first three months of 2017. The biggest public segment—highway and street construction—increased by 0.5 percent for the month but is down 2.4 percent year-to-date. The other major public category—educational construction—fell by 2.0 percent in March and by 2.6 percent for the combined January to March period.

Association officials say that the decline in public construction spending highlights the need for new infrastructure proposals. They add that many firms are eager for the administration to release details about the new plan, and significant new investments in infrastructure will help boost overall economic activity and support greater demand for construction services.

“If Washington officials can find a way to enact significant new infrastructure funding, we are likely to see even higher record levels of construction spending for the foreseeable future,” says Sandherr.

Latest from Construction & Demolition Recycling

- ALLU offers new crusher bucket

- Waste Pro files brief supporting pause of FMCSA CDL eligibility rule

- Des Moines project utilizes recycled wind turbine blades

- Vecoplan to present modular solutions at IFAT 2026

- Terex Ecotec appoints Bradley Equipment as Texas distributor

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest