Photo provided by iStock

A market update from a financial firm has portrayed what many recyclers of concrete and asphalt already know: The market for rock products is steady to strong in the United States.

Boston-based Capstone Partners says in its July 2023 market update on rock products that there is a favorable price environment and steady demand in the sector.

The investment banking firm cites “steady construction backlogs, robust employment growth and defensible gross margins” as allowing the aggregates sector “to remain largely insulated from an aggressive monetary tightening campaign and persistent levels of inflation.”

Capstone continues, “While near-term uncertainty has lingered for the broader economy, aggregates providers have benefited from a high degree of demand visibility—evidenced by construction backlogs remaining elevated in June at 8.9 months, according to Associated Builders and Contractors (ABC).”

As of July, interest rate hikes have not suppressed the labor market for construction workers, Capstone says, with ABC again referred to as a source noting the sector added 23,000 jobs in June. “Despite forecasts for a downturn in the near-term, contractors expect staffing levels, sales and profit margins to expand over the next six months,” Capstone adds.

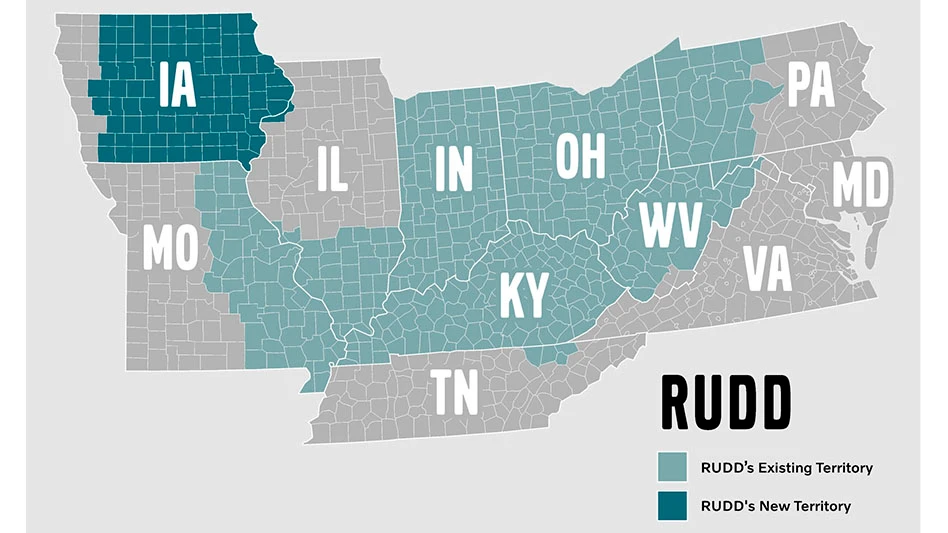

Earlier this month, an infrastructure project management firm stated it was adding staff throughout the Midwest as its project portfolio was growing in that region.

On the merger and acquisition (M&A) front, activity volume in the aggregates sector has moderated through year-to-date (YTD) 2023 “as many prospective sellers have awaited further market clarity before engaging in a liquidity event,” Capstone says.

At the halfway point in 2023, M&A activity in the sector has declined by 19.4 percent year over year to 50 total transactions. “Strategic buyers have overwhelmingly driven consolidation activity, accounting for 84 percent of total M&A volume, with private strategics comprising 60 percent of transactions,” Capstone states.

Publicly traded companies also have been active in M&A markets as acquirers and through divesting noncore assets or operations, says the investment bank.

Financial buyers, such as equity funds, “have been increasingly selective in their acquisition pursuits amid a heightened cost of capital and uncertainty in projecting cash flows,” Capstone writes. YTD, private equity acquirers have accounted for 16 percent of total transactions, which Capstone calls a significant decline from the 29 percent figure in 2022.

“The aggregates sector continues to perform well, in spite of bank closures, increasing interest rates and market volatility,” says Capstone Managing Director Darin Good, the lead contributor in the newly released report. “While M&A activity has moderated, quality companies have continued to draw buyer interest amid a backdrop of healthy sector fundamentals.”

The full report can be accessed from this web page.Latest from Construction & Demolition Recycling

- MB Crusher at ConExpo

- Reclaiming rebar from concrete with use of a self-cleaning suspended overhead magnet

- Suspended magnet options galore

- European Demolition Association selects Dublin for annual convention

- Are you missing out on money?

- Oregon shopping center could be nearing demolition

- Fraser Valley Junk Solutions expands service availability

- Carolinas AGC honors 2025 Pinnacle, Construction Excellence award recipients