Construction spending in the United States rallied in January, says the Arlington, Virginia-based Associated General Contractors of America (AGC), as private nonresidential construction increased for the first time in seven months.

The AGC’s analysis of monthly federal construction spending data still shows that nonresidential construction spending remains below pre-pandemic levels. The group’s CEO also has expressed his concern that rising materials prices and proposed labor law changes threaten the sector’s recovery.

Construction spending in January totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 1.7 percent from the pace in December and 5.8 percent higher than in January 2020. Residential construction jumped 2.5 percent for the month and 21 percent year-over-year, says the AGC. However, combined private and public nonresidential spending climbed just 0.9 percent from December and remained 5.0 percent below the year-ago level.

Private nonresidential construction spending rose 0.4 percent from December to January. The largest private nonresidential segment, power construction, fell 10.0 percent year-over-year and 0.8 percent from December to January, with more activity in that sector seemingly focused on the demolition of older, coal-powered plants.

Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 8.3 percent year-over-year and 1.8 percent for the month Office construction decreased 4.4 percent year-over-year and 0.2 percent in January. Manufacturing construction rose 4.9 percent compared with the month before, but was still 14.7 percent below the year-ago figure.

Public construction spending increased 2.9 percent year-over-year and 1.7 percent for the month, with highway and street construction rising 6.5 percent from a year earlier and 5.8 percent month-to month.

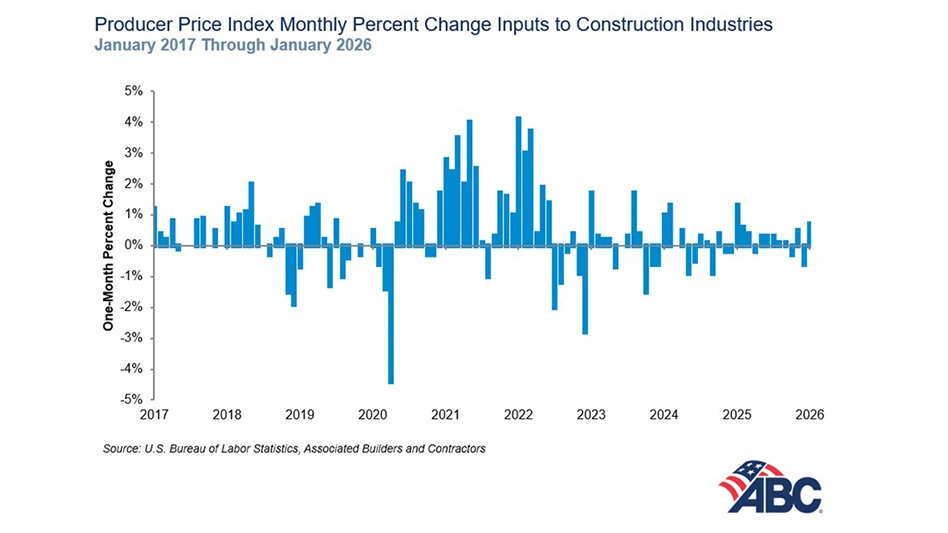

“Contractors are getting caught between rising materials prices and stagnant bid levels,” says Stephen E. Sandherr, the association’s CEO. “Add to that the possible threat of a new era of [labor-management disputes], and many contractors are worried that the recovery will end before it really starts.”

Latest from Construction & Demolition Recycling

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest

- Triumvirate Environmental acquires Environmental Waste Minimization

- Coastal Waste & Recycling expands recycling operations with Machinex

- Reconomy acquires German-based GfAW

- CommanderAI launches HaulerCentral database

- Glass Recycling Foundation releases 2025 Impact Report