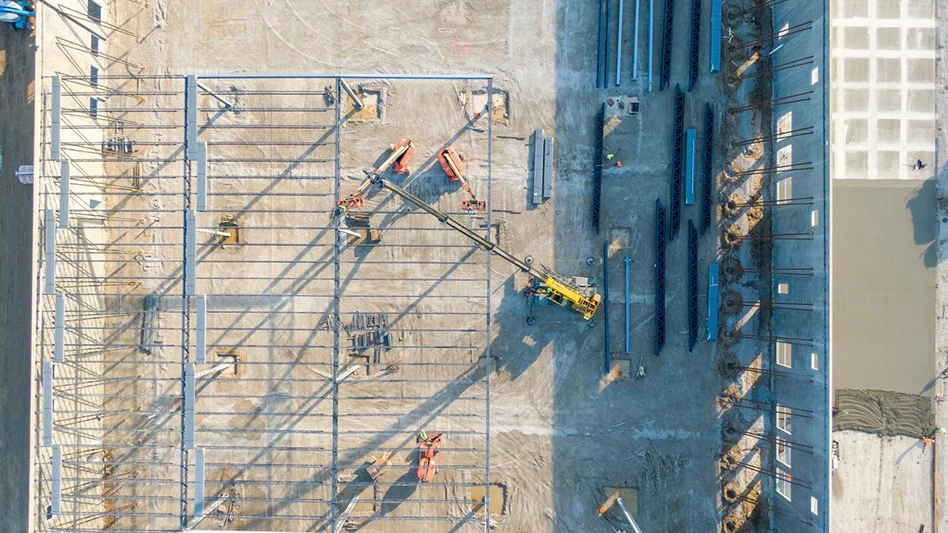

Tund | stock.adobe.com

This July, spending on construction projects underway declined by 0.1 percent compared with the previous month, according to federal government statistics analyzed by the Arlington, Virginia-based Associated General Contractors of America (AGC).

AGC says declines in private nonresidential and multifamily construction offset increases in single-family homebuilding and public infrastructure spending.

Officials say the figures are consistent with those from a survey it released in late August that found many property owners have canceled, deferred or scaled back projects due to tariffs and labor shortages.

“Our survey of construction firms found 16 percent of contractors reported projects had been canceled, postponed or scaled back as owners’ demand or needs changed due to tariffs, while 45 percent of firms report project delays because of labor shortages,” says Ken Simonson, AGC chief economist.

He says 26 percent of firms responding to the AGC survey said projects had been affected by changes in owners’ demand or need due to other policy changes such as federal funding, taxes and regulations.

This July, spending on construction in the United States totaled $2.14 trillion (at a seasonally adjusted annual rate), nearly identical to the May rate but down slightly from the June figure.

Contractors and subcontractors awaiting new projects to spur activity also could be concerned by the monthly American Institute of Architects (AIA)/Deltek Architecture Billings Index (ABI) figures in 2025.

The index composed by New York-based AIA and Virginia-based Deltek checked in at 46.3 based on a July survey, with any number below 50 indicating reduced billings. The ABI has been below 50 for 31 of the previous 34 months.

“The value of newly signed design contracts at firms declined again in July, as firms continue to struggle to convert inquiries into contracts for new projects,” AIA and software and information services provider Deltek say. “This has been an issue for nearly as long as billings have been declining, and reflects how soft business has been at many firms over the last two and a half years.”

In terms of immediate spending as analyzed by AGC, the four largest private nonresidential categories declined in July compared with June.

“Manufacturing and private power construction each slumped by 0.7 percent, [while] commercial construction slid 0.9 percent and private office construction dipped by 0.2 percent,” the group says.

AGC says the latest spending data and survey results underscore a need for greater policy certainty. The group is urging the Trump administration to quickly resolve trade disputes to end the threat of retaliatory tariffs.

On the immigration front, AGC says it favors “short and long-term workforce development measures, including new pathways for people to enter the country and work in construction and more investments in construction training and education programs.”

“It is difficult for developers to launch new construction projects when they don’t know how much the project will cost or how long it will take to finish," AGC CEO Jeffrey D. Shoaf says. "Providing greater certainty on tariff rates and taking steps to address severe construction labor shortages will go a long way in stimulating new demand for construction.”

Latest from Construction & Demolition Recycling

- Nucor finishes 2025 with 14 percent earnings decline

- G2 Consulting Group acquires Construction Testing Services

- CBI to showcase 5900T horizontal grinder at ConExpo 2026

- Steel Dynamics reports 2025 financial results

- Global steel output continues slide in December 2025

- Smart equipment maintenance: How geofencing drives productivity

- Demo Leaders launches zero-waste program

- BrightRidge to demolish 2 buildings in Tennessee