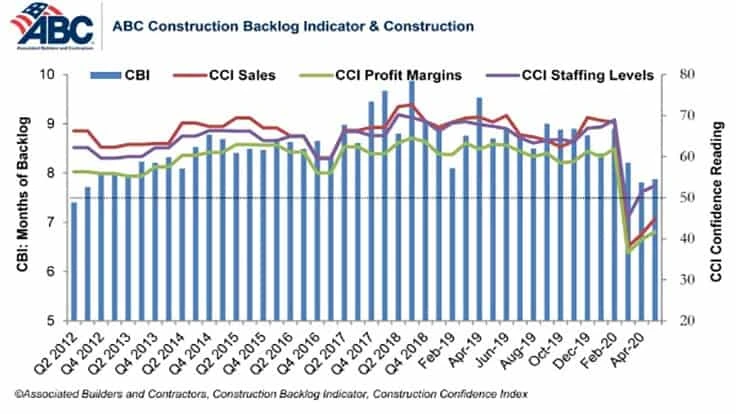

The Associated Builders and Contractors (ABC) reported June 9 that its Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading. This comes in addition to an ABC member survey conducted May 20-June 3, which indicates confidence among U.S. construction industry leaders continues to rebound from the historically low levels observed in the March survey.

“Given the depth of the economic downturn and myriad other issues facing America today, backlog and contractor confidence data have held up better than one might have anticipated. But the marketplace is still tilted toward pessimism,” says ABC Chief Economist Anirban Basu.

According to ABC, the nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry, classification and region. Backlog in the heavy industrial category, however, increased by nearly one month in May after reaching its lowest level in the history of the series in April.

The association’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased in May, although sales and profit margin expectations remain below the threshold of 50, indicating ongoing expectations of contraction. The staffing level index remained above that threshold, with more than 38 percent of contractors expecting to expand their staff during the next six months.

More than 45 percent of contractors expect their sales to decline during the next six months while 35 percent expect sales to increase. More than 48 percent of contractors expect their profit margins to decrease over the next two quarters.

“After falling meaningfully in April, backlog remained relatively unchanged in May, hinting at a stable nonresidential construction marketplace,” says Basu. “However, the underlying survey received fewer responses compared to earlier months in the COVID-19 crisis, perhaps suggesting that some contractors are no longer operating at previous capacity, inducing available work to move toward better-positioned contractors. To the extent that these stronger contractors are reflected in the survey, this would tend to bolster average backlog even in the context of a subdued marketplace.”

Basu adds, “Contractors still expect to boost staffing levels over the next six months. But this may simply be a function of job sites reopening as construction shutdowns end. Almost 70 percent of respondents had job sites shut down due to government mandates and other reasons, and with labor shortages in place before the pandemic, contractors may have residual staffing needs. It remains to be seen whether expected employment growth going forward coincides with speedy recovery in overall contractor confidence and backlog.”

Latest from Construction & Demolition Recycling

- Vecoplan to present modular solutions at IFAT 2026

- Terex Ecotec appoints Bradley Equipment as Texas distributor

- Greenwave raises revenue but loses money in Q2 2025

- Recycled steel prices hold steady

- John Deere launches ‘Building America’ excavator contest

- Triumvirate Environmental acquires Environmental Waste Minimization

- Coastal Waste & Recycling expands recycling operations with Machinex

- Reconomy acquires German-based GfAW