As disposal capacity tightens in markets in the Northeast and Pacific Northwest, waste companies have been increasing their focus on rail waste transfer.

The Woodlands, Texas-based Waste Connections acquired the rail-served Arrowhead landfill in Alabama in 2023, and Rutland, Vermont-based Casella is completing rail infrastructure improvements to its McKean Landfill in western Pennsylvania, set to be operational this summer.

These reports were shared by Trevor Romeo with Chicago-based investment bank William Blair as part of a WasteExpo 2025 equity research report, in which he noted that private companies also have amped up rail capacity.

In the Northeast, Interstate Waste Services, Teaneck, New Jersey, operates one of the largest waste-by-rail networks in the country, with a strategic network of three unit train facilities and two gondola facilities connecting the Northeast region to the company’s Apex Landfill in Amsterdam, Ohio.

Based in Portsmouth, New Hampshire, WIN Waste Innovations offers an extensive rail transportation network that allows the company to reach any rail-served location in North America, says Brian La Mora, vice president of rail for WIN Waste Innovations.

When compared with long-haul trucking, advantages of rail transfer include larger loads per shipment, more efficient fuel consumption and the potential for lower ongoing operating costs, Romeo says.

While a tractor-trailer can typically accommodate about 25 tons of materials, a railcar can handle up to 110 tons, which means one railcar can accommodate up to four or five tractor-trailer loads of material, says John Thomas, board president for the Construction & Demolition Recycling Association and managing partner for Waste & Recycling Solutions, Maine.

Material transfer by rail also lowers outbound traffic, reduces the carbon footprint of a business and provides more reliability than standard transportation, Thomas says. Another major advantage is tip rates, especially for companies in the mid-Atlantic region, which includes New York and New Jersery.

“In that market, people are attracted to rail because the tip rates in Ohio and down in Alabama and Georgia are much cheaper than local tip rates—significantly cheaper,” Thomas says.

However, rail transfer requires specialized infrastructure with significant upfront capital expenditures, consistent volume and an ideal location to be successful.

“Waste-by-rail is a more sustainable and cost-efficient method of transport once the infrastructure is created and the permitting process is completed,” La Mora says.

Some companies factor rail into a bigger materials management strategy, Thomas says. For instance, they could use rail to move other commodities, such as iron, steel, scrap or even liquids.

“A lot of these guys, if they have enough rail infrastructure on their location and enough switches, they’ll commingle cars and provide other services to supplement their income on the cost of their own rail,” he says.

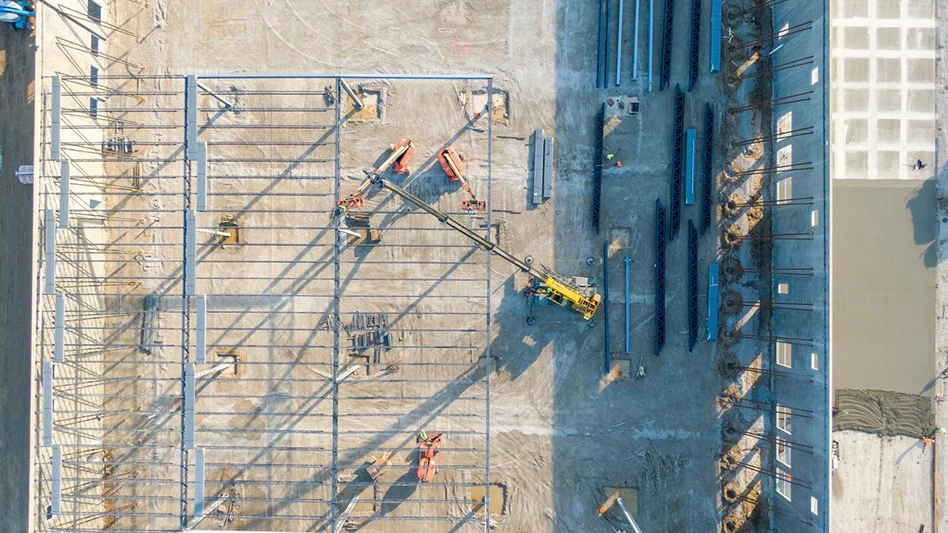

Rail waste transfer infrastructure needs

Setting up a successful rail transfer operation is a complex process, La Mora says. For companies looking to integrate rail transfer into their waste operations, the most important consideration is proximity to rail.

It’s essential to have a transfer building and a rail spur adjacent to the rail, and identifying that location and obtaining proper permitting requires close coordination with local permitting authorities and government agencies, La Mora says.

Typically, once a suitable location has been identified, a company will contract with a short-line provider to transport cars between the transfer station and the main railway line. The average cost of short-line service in the U.S. is $400 per car, Thomas says.

Rail waste transfer equipment needs

Both municipal solid waste (MSW) and construction and demolition (C&D) facilities transfer material by rail, but MSW and C&D debris require different types of equipment, Thomas says. For transferring C&D material, which would include anything that can’t be recycled, a gondola-type car is typically used.

While railcars transferring MSW need to be completely sealed so no odor or liquid can leach out, gondola cars don’t need a hard, sealed cover, Thomas says. Instead, they can use netting over the top of the cars to prevent materials from falling out.

Excavators are most often used to load railroad cars, La Mora says, though baling systems are used in certain applications.

Challenges of rail

The biggest challenge for businesses setting up transfer by rail is the significant capital outlay, Thomas says. A new gondola car for C&D rail transfer costs about $140,000, he says.

“Now, that car should last more than at least 40 years, so there’s very low maintenance,” Thomas says.

However, because of the turnaround time required to move cars between a company’s transfer station and the landfill, the number of cars required to get rail transfer up and running is higher than what companies initially might anticipate.

For instance, a New York-based transfer station that wants to ship 1,000 tons per day to an Ohio landfill would require about 120 cars to be successful, Thomas says. That’s because, at any given time, 40 cars will be traveling to the landfill and 40 will be coming back to the transfer station, while 20 will be on-site getting loaded and another 20 will be on the landfill site getting offloaded.

“As a rule of thumb … the typical turn on a car from the time you load it, ship it to a landfill and it comes back is about two-and-a-half weeks,” Thomas says of C&D material transfer by rail. “If it extends more than that, then you would have to have additional cars.”

Option to lease

For companies wanting to explore rail transfer without purchasing equipment, leasing providers will charge per car for their equipment, Thomas says.

As part of its service offerings, WIN Waste will lease its gondola cars to any customer that uses the company’s network of rail-served, end-of-life facilities for disposal. This service allows customers to take advantage of the rail operation WIN Waste has implemented without going through the complex process of setting up their own waste-by-rail infrastructure, he adds.

“We work collaboratively with customers and railroads, supporting new transfer stations in their transition to rail,” La Mora says. “Once on board, WIN also provides logistical support to manage the fleet to and from their facilities.”

Future of rail waste transfer

Romeo says he sees potential for volumes on existing rail to ramp up further in the coming years.

“With infrastructure already in place at these locations,” he says, “we believe this could be an attractive way to focus precious airspace in constrained markets on high-value tons, maintain a defensive safety valve to ensure capacity as landfills in local markets could close and increase internalization. We also see potential for new rail infrastructure to be built in the coming years as disposal constraints intensify, although this will require significant upfront capital and ramp-up time.”

Explore the July/August 2025 Issue

Check out more from this issue and find your next story to read.

Latest from Construction & Demolition Recycling

- Maverick Environmental Equipment opens Detroit-area location

- Nucor finishes 2025 with 14 percent earnings decline

- G2 Consulting Group acquires Construction Testing Services

- CBI to showcase 5900T horizontal grinder at ConExpo 2026

- Steel Dynamics reports 2025 financial results

- Global steel output continues slide in December 2025

- Smart equipment maintenance: How geofencing drives productivity

- Demo Leaders launches zero-waste program